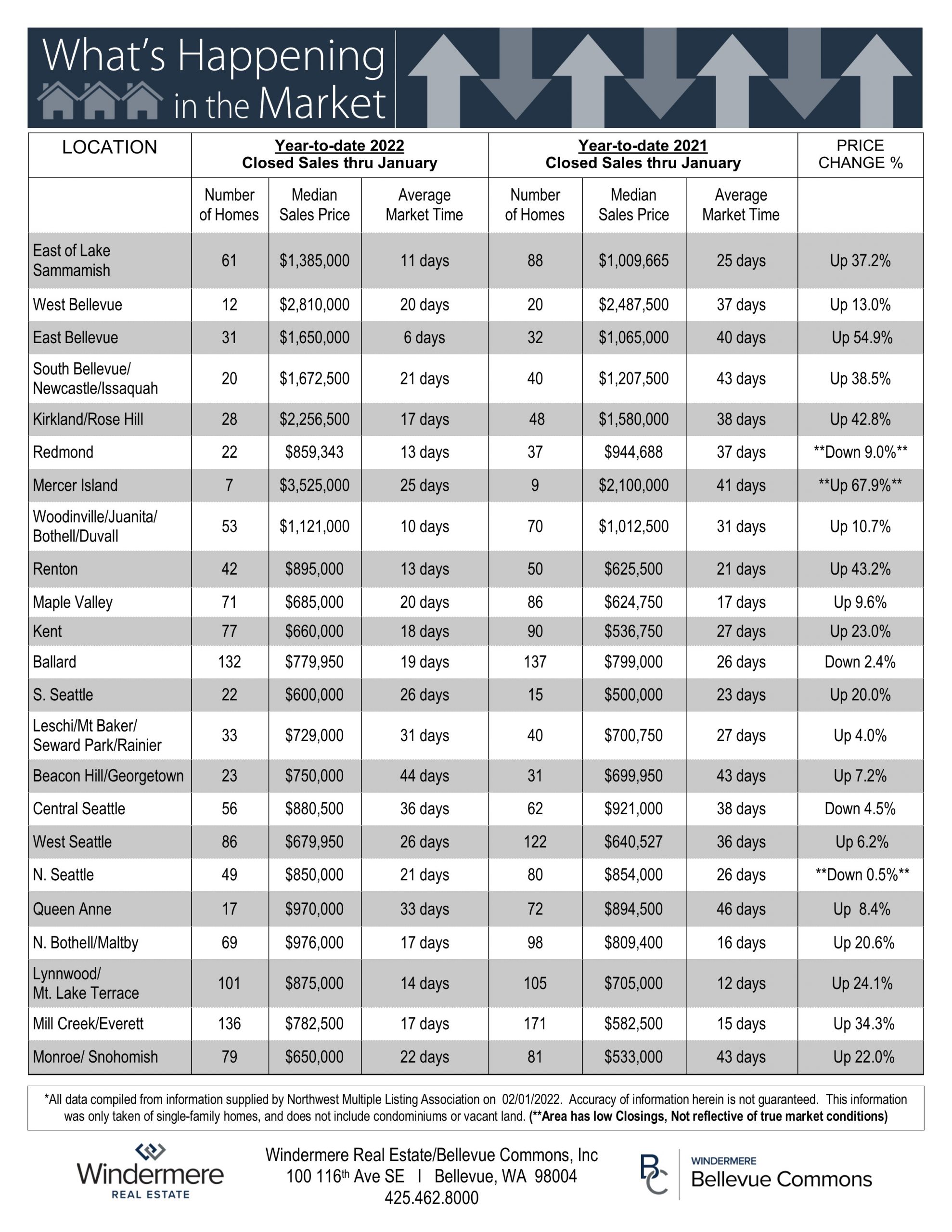

January 2022 YTD Stats in the Seattle/Bellevue area

Matthew Gardner Report for Western WA – 2021 Q3

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

REGIONAL ECONOMIC OVERVIEW

The emergence of the of COVID-19 Delta variant had a palpable impact on the region’s economy, which, naturally, impacted the job recovery. Employment levels in Western Washington had been picking up steam in the spring but started to slow quite dramatically over the summer. To date, the region has recovered more than 201,000 of the jobs that were lost due to the pandemic, but we appear to be in a bit of a holding pattern. That said, the ending of enhanced unemployment benefits has led many business owners to see more applicants for open positions, so I am hopeful the numbers will pick back up as we move into the winter months. The most recent data (August) shows the region’s unemployment rate at a respectable 5%, but we still have a way to go before we reach the pre-pandemic low of 3.7%. On a county level, the lowest unemployment rate was in Kitsap County (4.4%) and the highest was in Grays Harbor County (6.6%). There are still many hurdles in front of us, but I believe we will continue to add jobs and reach full employment recovery by mid-2022.

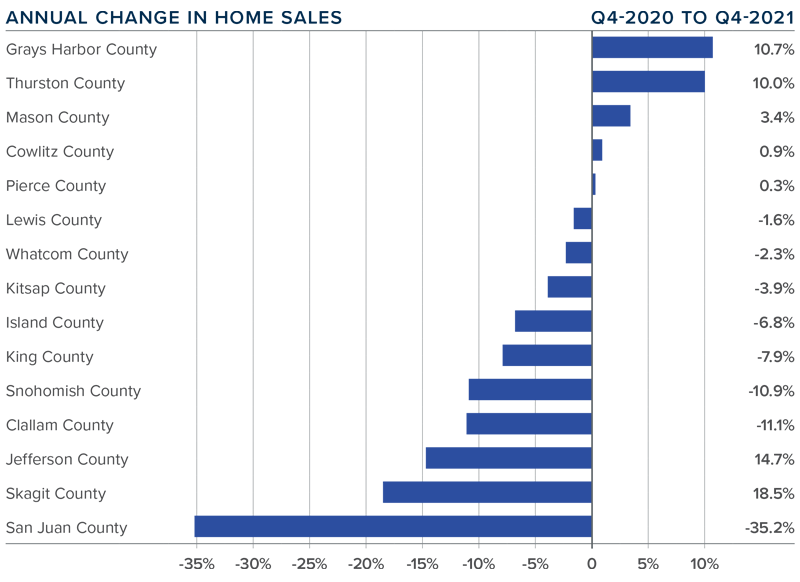

WESTERN WASHINGTON HOME SALES

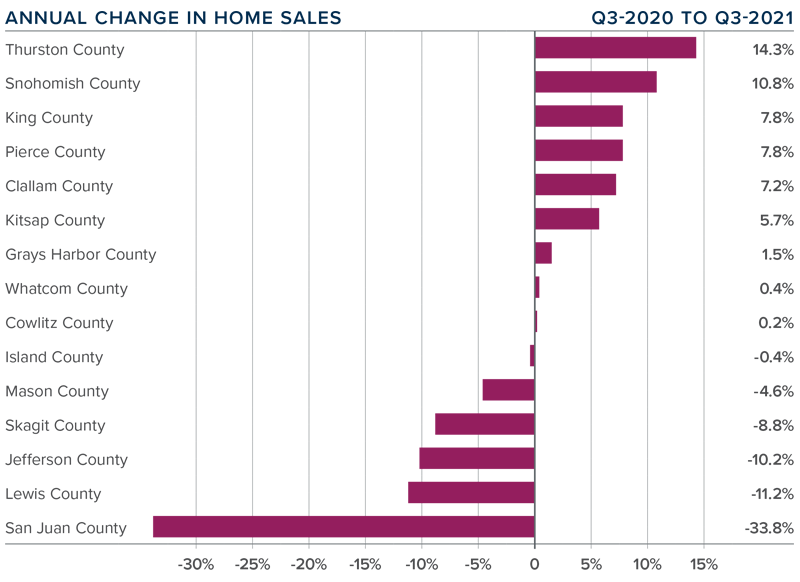

❱ Sales in the third quarter rose 6.4% year over year, with a total of 27,280 homes sold. The increase matched what we saw in the second quarter of this year.

❱ I was pleased to see sales growth continue. This rise was supported by a 28.4% increase in the number of homes for sale. Listings rose the most in Grays Harbor (+62.6%), Lewis (+53.6%), and Skagit (+52.0%) counties.

❱ Sales activity was mixed. Nine counties saw year-over-year growth, but sales slowed in six counties. That said, sales were up in every county other than King and San Juan compared to the second quarter of 2021.

❱ The ratio of pending sales (demand) to active listings (supply) showed pending sales outpacing listings by a factor of 4.6. Even with the increase in the number of new listings, the market is far from balanced.

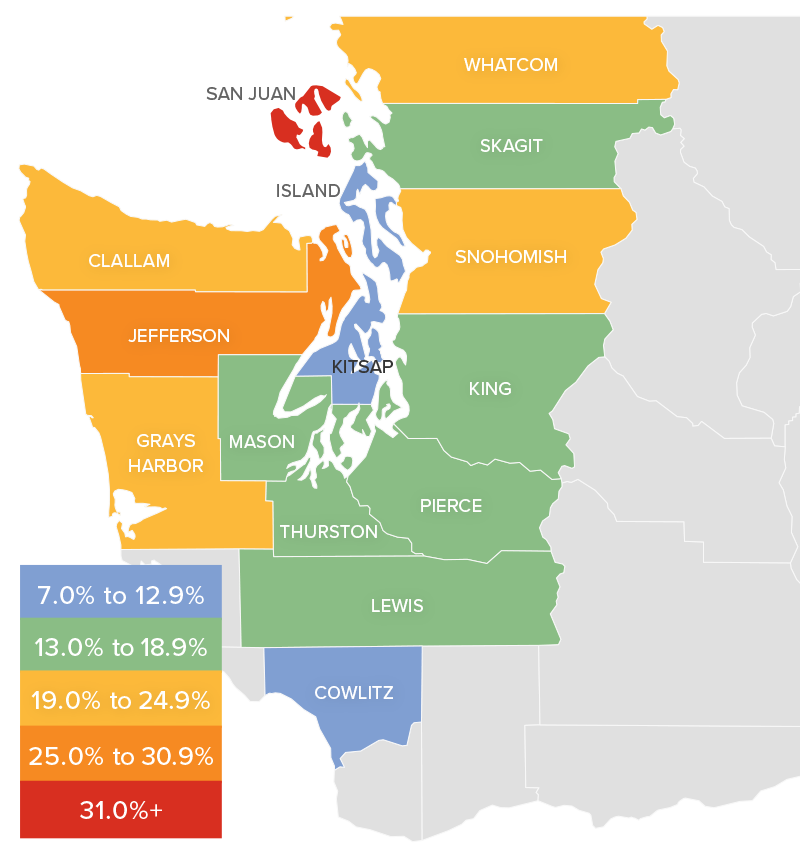

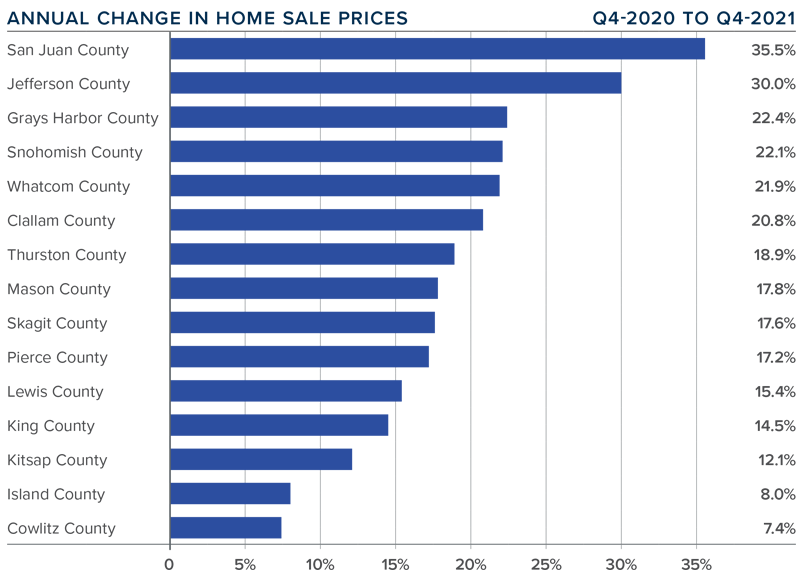

WESTERN WASHINGTON HOME PRICES

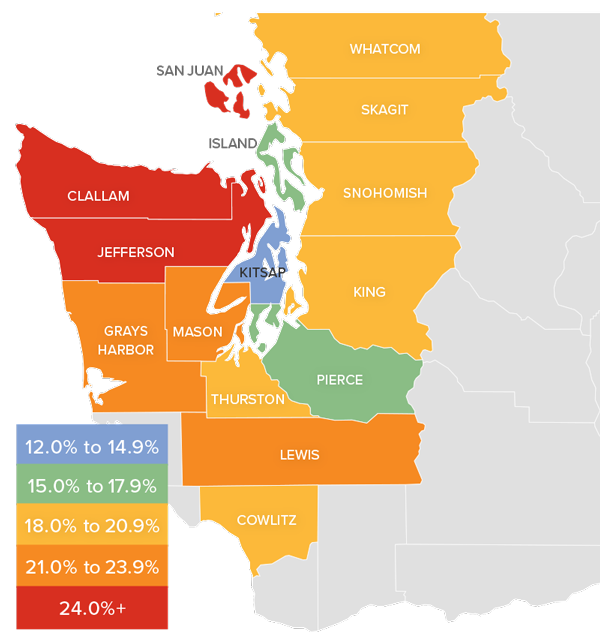

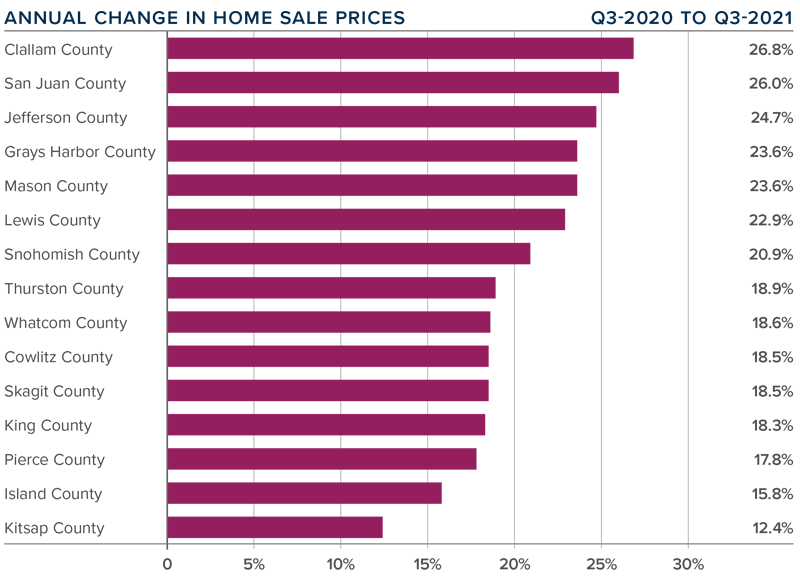

❱ Home prices rose 18.9% compared to a year ago, with an average sale price of $726,168—another all-time record.

❱ When compared to the same period a year ago, price growth was strongest in Clallam, San Juan, and Jefferson counties, but all markets saw prices rise more than 12% from a year ago.

❱ Average sale prices pulled back 1.1% compared to the second quarter of this year. Given the massive increase in value over the past few years, it is not at all surprising. The key indicator has been a softening in list prices and that naturally translates to slower price growth. This is nothing to be worried about. It simply suggests that the market may finally be heading back to some sort of balance.

❱ Relative to the second quarter of this year, all counties except San Juan (-0.1%), Island (-0.5%), and Whatcom (-0.5%) saw higher sale prices.

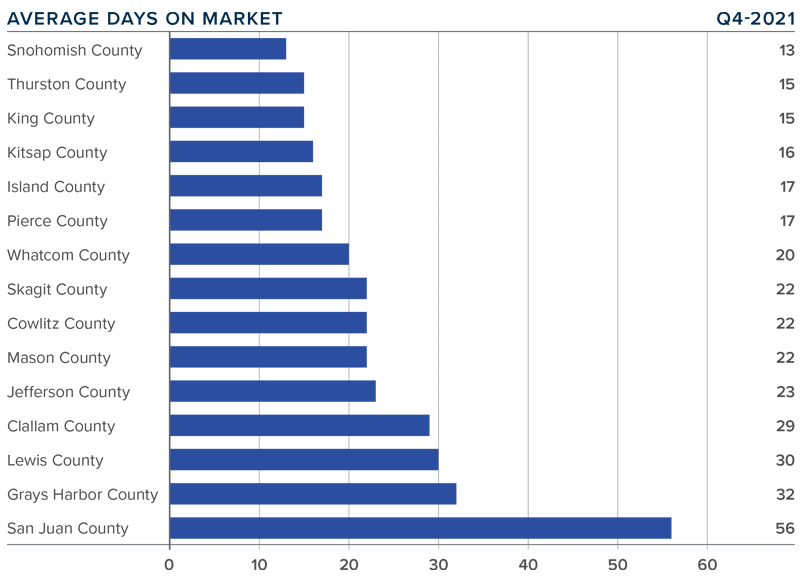

DAYS ON MARKET

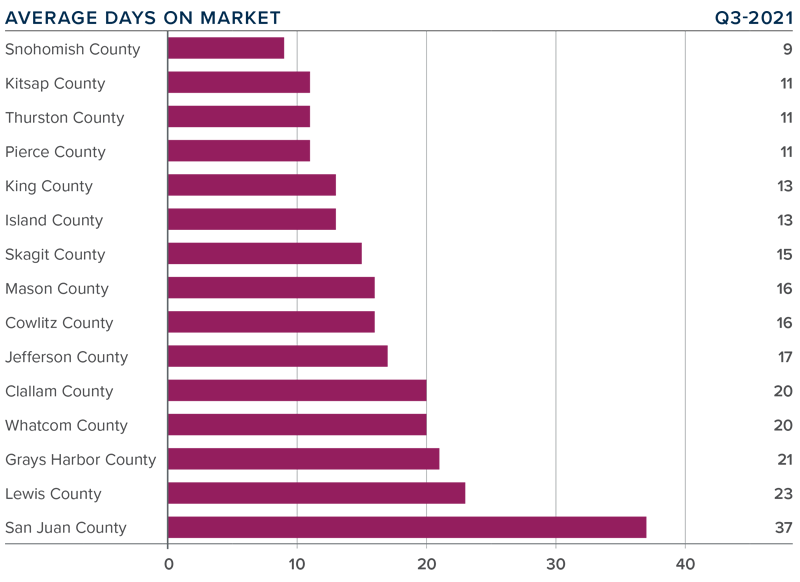

❱ It took an average of 17 days for a home to sell in the third quarter. This was 19 fewer days than in the same quarter of 2020, and 1 fewer day than in the second quarter of this year.

❱ Mirroring the second quarter, Snohomish, Kitsap, Thurston, and Pierce counties were the tightest markets in Western Washington, with homes taking an average of 9 days to sell in Snohomish County and 11 days in the other three counties. The greatest reduction in market time compared to a year ago was in San Juan County where it took 102 fewer days for homes to sell.

❱ All counties contained in this report saw the average time on market drop from the same period a year ago, but eight counties saw market time rise from the second quarter; however, the increases were minimal.

❱ Even with inventory levels increasing in most markets, the region’s housing market remains remarkably tight. That said, I do see some of the heat dissipating and I am hopeful that if inventory levels continue rising, we will start a slow move back toward a balanced market.

CONCLUSIONS

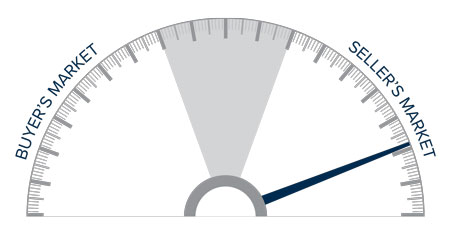

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Even given the speedbump that hit the region’s economy with the emergence of the Delta variant, the housing market remains remarkably resilient. Demand from buyers continues to be very strong, and modestly increasing inventory levels appear to have—at least for the time being—reduced some of the fever from the market. Mortgage rates remain very favorable, and my current forecast is for them to stay in the low- to mid-3% range until next summer. Rising inventory levels have led price growth to slow and days on market to start increasing, which may be a sign that the market is retreating from a prolonged period of exuberance.

As we move through the balance of the year, I believe demand will remain solid, but we will continue to see price growth soften as more listings compete for the buyers that are out there. That is not to say price growth will turn negative; rather it suggests that we are slowly moving back toward a more balanced market. That said, the market certainly still favors home sellers. As such, I am leaving the needle in the same position as the second quarter. I may move it a little in the direction of buyers next quarter if the current trend continues through the winter months.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for

Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog.

Annual Shredding and Recycling Event 2021

Hello Neighbors,

together with my team at Windermere Real Estate/Maple Valley, I have the pleasure to invite you to our annual FREE paper-shredding and recycling event 2021!

It will take place in front of our office at 22017 SE Wax Road, and it is on Saturday, May 1st from 10:00am, until 1:00pm. Some small computer electronics will be accepted for recycling as well. The full list could be found in the flyer below.

Monetary and food donations will be collected for the Maple Valley Food Bank. According to their representatve, currently breakfast items are most needed.

Gather up those old receipts and bring them over for safe desposal. Due to Covid-19 restrictions, masks and social distancing will be required during the entirety of the event.

Hope to see you there!

Governor Inslee Updates Stay-at-Home Order Affecting Real Estate Brokers

The Covid-19 pandemic has affected every single person in our country and around the world. Needless to say, along with in all other aspects of our lives, there is a new order of conducting business and we are all learning to adapt to the implemented changes. Frequently, those changes are updated daily and it is more imperative now than ever that we, real estate Brokers, are keeping our clients safe while protecting our own health. We are all in this together and it is our duty to work together and raise stronger as a community!

The need to allow members of our community to complete real estate transactions has been recognized, as the treat of displacement is a pressing issue in the PNW. We are now able to perform some of our Realtor® duties, however, there are certain restrictions. According to the latest Governor’s order, as of March 28th, 2020 brokers and one additional person are allowed to preview a property as long as social distancing rules are observed.

Seattle King County REALTORS® summarizes the restrictions in detail in the FAQs:

As aforementioned, changes are made some times daily, so please contact me or check back for any updates. Stay safe, stay healthy!!

Windermere/Maple Valley Spring Shredding Event

UPDATE: The event was postponed due to the Covid-19 pandemic. The new date is TBD. I apologize for any inconvenience!

PLEASE JOIN ME AND WINDERMERE/MAPLE VALLEY FOR THIS

FREE SPRING SHREDDING EVENT!

We have partnered with SEADRUNAR Recycling to bring you this event on Saturday, April 11, 2020 11:00 AM-2:00 PM. The shredding truck will be parked in our office building parking lot located at 22017 SE Wax Road, Maple Valley, WA 98030.

You are also invited to ring the following items for FREE recycling:

• Computers – Laptops / Servers / Printers

• LCD Monitors / LCD TV’s

• Printer Ink / Toner

• Networking items / Server Racks / Hard Drives / Circuit Boards Wire / UPS Battery Backups / Computer Accessories

• Medical Equipment

• Cable Boxes

• Video Game / Consoles

• Washers / Dryers

• Metal Items

• Home Electronics – MP3 Players / Cell Phones / Ipad’s / Tablets / Video Games / Stereo Equipment / Misc. Electronics

If you’d like any additional information, feel free to contact me! I hope to see you there!

So… how is the Real Estate business?

It is that time of the year – for parties and celebrations, generosity and giving, spending time with loved ones and appreciating the little things. I have been witnessing goodness and joy all around and absolutely love every second of it.

I have also had the opportunity to attend quite a few events lately, and to spend time with some old friends and some new ones. Inevitably, the question of the state of the real estate market and the ever-so dreaded recession in the economy comes up in a conversation. And yes, we all do remember the last big one at the end of the last decade, and many of us were affected by the startling events that unfolded in the real estate market. Being part of that industry now has made me extra aware and cautious of all changes happening currently.

The NWMLS just released the statistics for November and it looks like the numbers managed to surprise everyone. According to the report, in November, there were “plenty of buyers” competing for the sparse inventory. That led to a 9.2% increase in year-over-year mutually accepted offers compared to the same month last year.

In King County the median sale price was $612,000 which was a one percent higher than last year. According to Dick Beeson, a member of the MLS board of directors, unlike the rest of the U.S., the pending sales were not on the decline in the Puget Sound. The year-over-year of pending sales for the King, Pierce and Snohomish counties have gone up by 9%, however the housing market here has virtually sold-out of the mid-price range.

Another economy expert who’s reports I follow closely is Windermere’s Chief Economist Matthew Gardner. In his 2020 forecast for the US economy he predicts that the recession will begin either next year or, at the latest, in 2021. However, it will not be nearly as catastrophic as the last one we had.

The economy will continue grow and the number of jobs will as well, but at a much smaller scale, about 2%, than the one we have witnessed during the last decade.

As far as the real estate market, Mr. Gardner predicts that the home sales will be somewhat slowing down and the home price growth will measure about 3.9% growth year-over-year.

As far as new construction homes, he predicts that there will be a growth in the number of units sold, however, the increasing cost of building new homes will prevent the pricing of going up by more than about than 1.5%.

Mortgage interest rates will grow a bit, but not drastically and first-time home buyers will be entering the market more prominently, according to the forecast.

In conclusion, YES – the recession will happen. It’s only a normal part of the business cycle. However, it will not be as catastrophic as what we have witnessed in the past and with careful planning we will be prepared and be able to move forward. In the meantime, I will continue to follow the market trends and keep informed on the latest developments. Because I care!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link